oregon tax payment voucher

Write Form OR-19-V your daytime phone the entitys federal employer identi- fication number FEIN and the tax year on the payment. According to the Department of Revenue website the Revenue Online system will be ready to accept PTE-E activity after June 6.

Oregon Estimated Tax Payment Voucher 2021 Fill Online Printable Fillable Blank Pdffiller

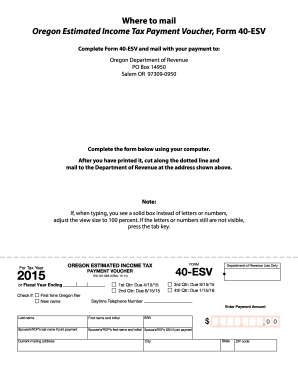

Get and Sign Oregon Estimated Tax Payment Voucher 2015-2022 Form Get started with a oregon estimated tax form 2015 complete it in a few clicks and submit it securely.

. Dont submit photocopies or use staples. Ad Fill Sign Email OR OR-65-V More Fillable Forms Register and Subscribe Now. Form OR-706-V Oregon Estate Transfer Tax Payment Voucher.

Use blue or black ink. Show details How it works Upload the oregon estimated income Edit sign oregon estimated income payment voucher from anywhere Save your changes and share form 40 esv. Use this voucher only if you are making a payment without a return.

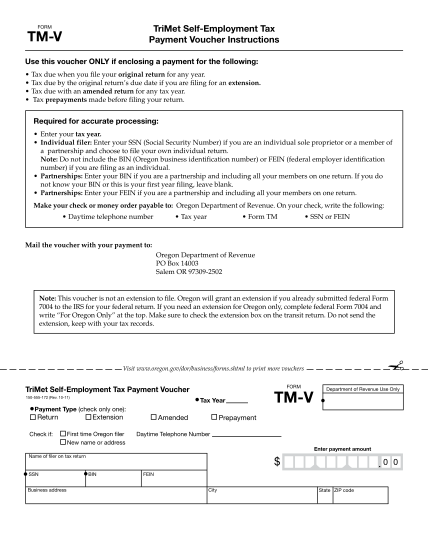

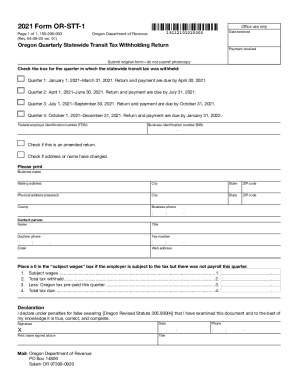

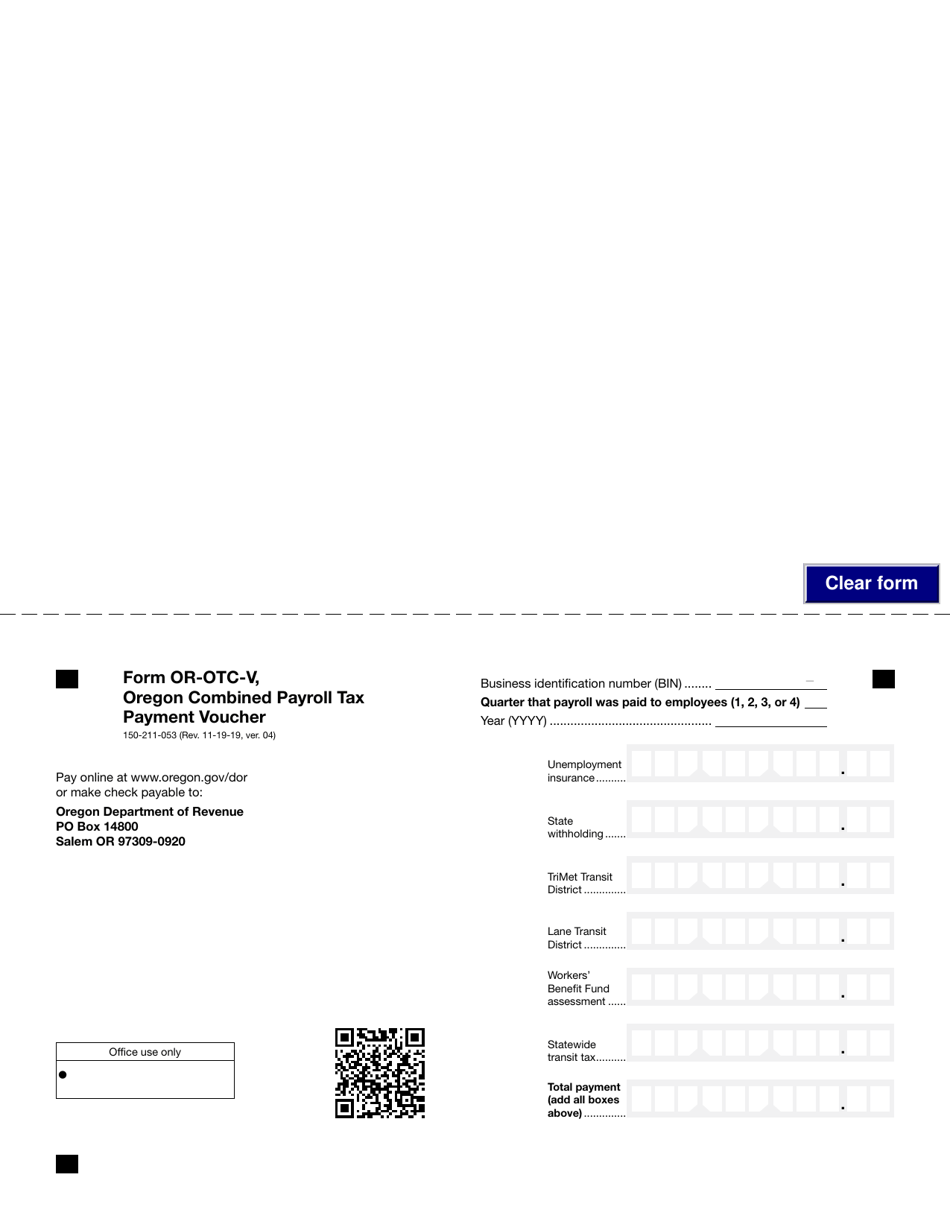

Form OR-NRC-CERT Annual Certification for Oregon Natural Resource Credit. Oregon Department of RevenuePO Box 14800Salem OR 97309-0920 Office use only Business identification number BIN Quarter that payroll was paid to employees 1 2 3 or 4. Cut on dashed line below to detach voucher.

City of Portland Oregon. Mail the payment and voucher to. Make your check money order or cashiers check payable to the Oregon Department of Revenue.

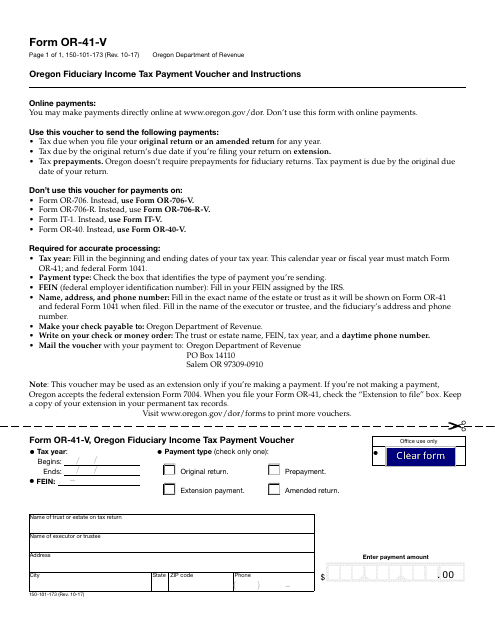

Check the appropriate box for the type of payment being made and completely fill out the form. Mail the voucher and payment. Use the voucher only if you are paying by check or money order.

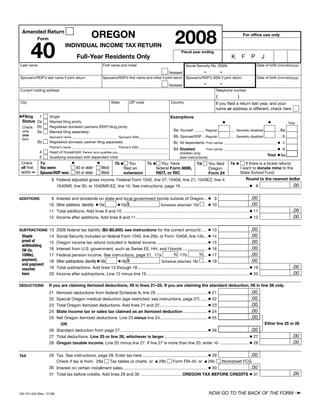

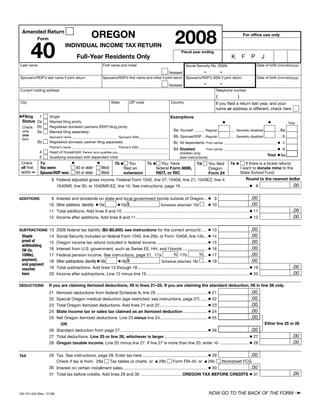

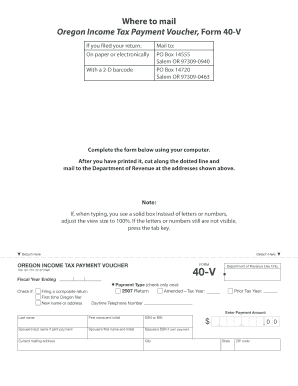

Call at least 48 hours in advance 503 945-8050. Clear form Form OR-40-V Oregon Department of Revenue Oregon Individual Income Tax Payment Voucher Page 1 of 1 Use UPPERCASE letters. Resident Individual Income Tax Return Extension.

Payment vouchers are provided to accompany checks mailed to pay off tax liabilities and are used by the revenue department to record the purpose of the check and the SSNEIN of the taxpayer who sent it. Print actual size 100. Form OR-OTC-V Oregon Combined Payroll Tax Payment Voucher 150-211-053 Rev.

Do not staple payment to voucher. Oregon Form 40-V Payment Voucher for Income Tax - 2020. Oregon Department of Revenue PO Box 14950 Salem OR 97309-0950.

Make your check money order or cashiers check payable to the Oregon Department of Revenue. Form OR-DECD-TAX Final Tax and Discharge of a Decedents Estate. Form 40-V is an Oregon Individual Income Tax form.

Oregon Department of Revenue PO Box 14800 Salem OR 97309-0920 Form OR-OTC-V Oregon Combined Payroll Tax Payment Voucher 150-211-053 Rev. Mail the completed voucher with payment on or before the payment due date to. Oregon uses Form 40-V the payment voucher to file an extension request with payment - just check the extension payment checkbox to apply for an automatic six-month extension of time to file your Oregon return.

Oregon department of revenue po box 14800 salem or 97309-0920. Application for Automatic Extension of Time to File Individual Tax Return Extension. Form OR-706-V Oregon Estate Transfer Tax Payment Voucher Instructions.

Estimated Income Tax Payment Voucher Estimated. Form 20-V is an Oregon Corporate Income Tax form. SSN SSN Current mailing address City State ZIP code Contact phone Enter payment amount Form OR-40-V Oregon Individual Income Tax Payment Voucher Office use only.

For tax years beginning on or after January 1 2021 you will use BZT-V and CES-V to make quarterly estimated payments. Use blue or black ink. In order to make the quarterly payments either use Oregon Voucher OR-21-V or make the online payment through the entitys Revenue Online account.

More about the Oregon Form 40-ESV Individual Income Tax Estimated TY 2020 If you are self employed or do not pay tax withholding you need to pay quarterly taxes using form 40-V the form replacing 40-ESV which is the estimated income tax voucher. Oregon Department of Revenue at httpegovoregongovDOR. Use this instruction booklet to help you fill out and file your vouchers.

You can still make estimated tax payments even if you expect that your tax after all credits will be less than 1000. Enter payment amount Oregon Corporate Activity Tax Payment Voucher Page 1 of 1 Oregon Department of Revenue Use UPPERCASE letters. Your browser appears to have cookies disabled.

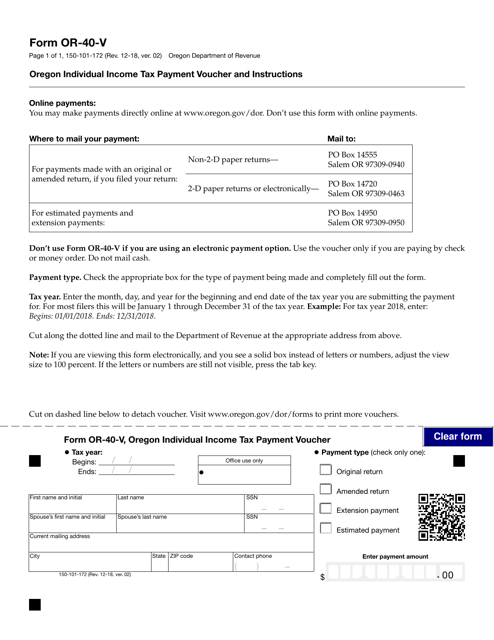

Enter the month day and year for the beginning and end date of the tax year you are submitting the payment for. Designated CAT entity address City Contact phone State Last name ZIP code Social Security number SSN First name Initial. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities and are used by the revenue department to record the purpose of the check and the SSNEIN of the taxpayer who sent it.

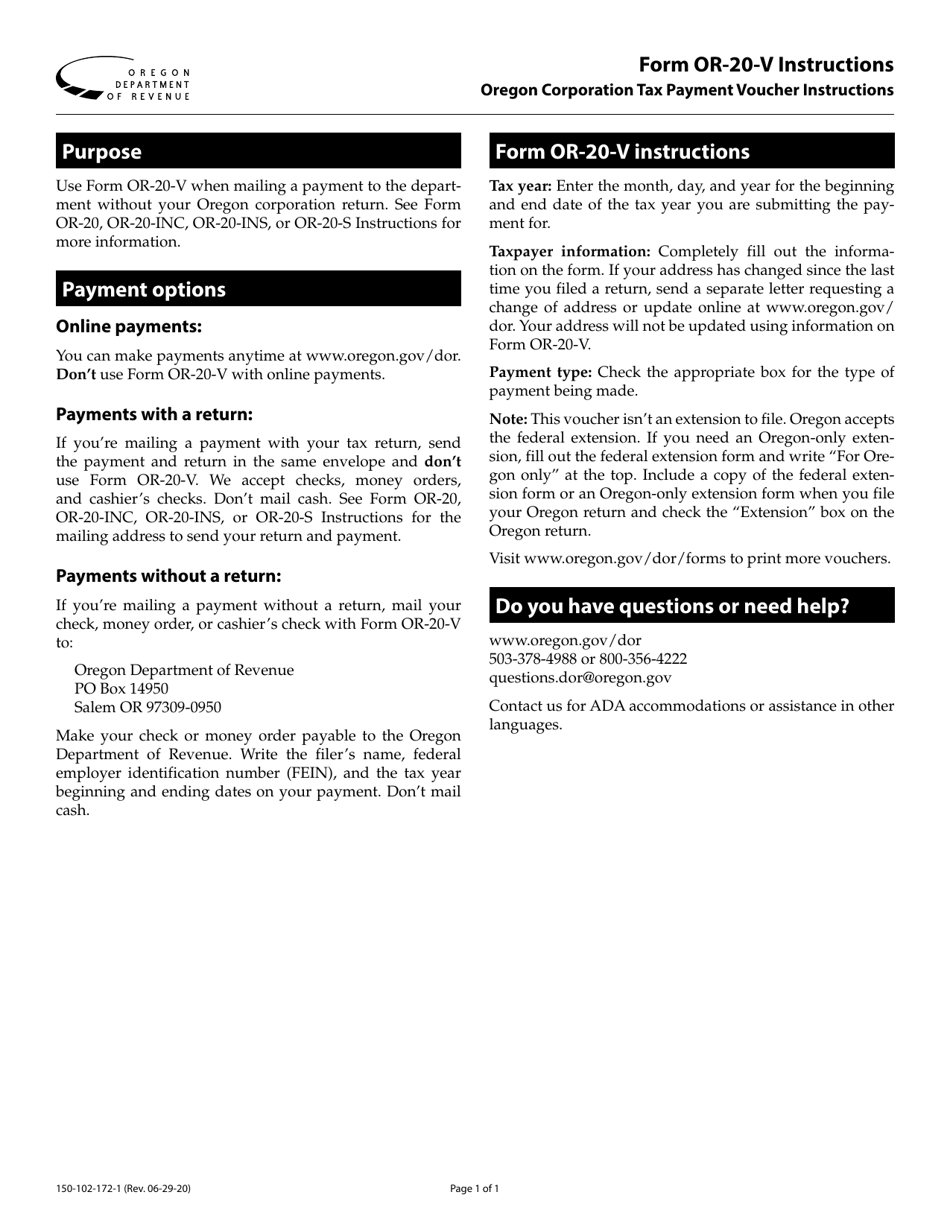

Enter payment amount Tax year begins MMDDYYYY Tax year ends MMDDYYYY Oregon Individual Income Tax Payment Voucher Page 1 of 1 Oregon Department of Revenue Payment type check one Use UPPERCASE letters. Write Form OR-20-V the filers name federal employer identification number FEIN the tax year beginning and ending dates and a daytime phone on your payment. Use blue or black ink.

Print actual size 100. Form 40-V is an Oregon Individual Income Tax form. Mail check or money order with voucher to.

Print actual size 100. Clear form Form OR-40-V Oregon Department of Revenue Oregon Individual Income Tax Payment Voucher Page 1 of 1 Use UPPERCASE letters. To ensure proper credit to your account write the filers name fein bin and appropriate tax period on your check.

04 Pay online at wwworegongovdor or make check payable to. Retirees If youre retired or will retire in 2022 you may need to make estimated tax payments or have Oregon income tax withheld. Oregon Marijuana Tax Oregon Department of Revenue PO Box 14630 Salem OR 97309-5050.

Bring this voucher and your payment to the Oregon Department of Revenues Salem office at 955 Center St NE Salem OR 97301. Oregon will honor all federal extensions of time to file individual income tax returns as valid Oregon extensions. Do not mail cash.

Oregon Department of Revenue Form OR-40-V Oregon Individual Income Tax Payment Voucher and Instructions Page 1 of 1 150-101-172 Rev. Cash payments must be made at our Salem headquarters located at. For instructions including a worksheet to help you calculate your payment amount please see Form OR-MT-CALC.

Cookies are required to use this site. Visit wwworegongovdorforms to print more vouchers. Learn more about marijuana tax requirements.

Estimated Income Tax Payment Voucher Estimated. Download PDF file Form BZT-V. Dont submit photocopies or use staples.

Make check payable to oregon department of revenue. Payment Voucher for Income Tax Voucher. Dont submit photocopies or use staples.

Under Senate Bill 1524 timely estimated tax payments are required to avoid. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities and are used by the revenue department to record the purpose of the check and the SSNEIN of the taxpayer who sent it. PortlandMultnomah County Combined Business Tax Payment Voucher.

Form OR-40-V Oregon Individual Income Tax Payment Voucher 150-101-172. Ad Download or Email OR OR-40-V More Fillable Forms Register and Subscribe Now.

Form 50 101 172 Or 40 V Download Fillable Pdf Or Fill Online Oregon Individual Income Tax Payment Voucher Oregon Templateroller

Download Instructions For Form Or 20 V 150 102 172 Oregon Corporation Tax Payment Voucher Pdf Templateroller

Oregon Tax Forms 2021 Printable State Form Or 40 And Form Or 40 Instructions

Fill Free Fillable Forms For The State Of Oregon

Get And Sign Oregon Estimated Tax Payment Voucher 2015 2022 Form

Egov Oregon Gov Dor Pertax 101 040 08

Fillable Online Oregon Form 20 V Oregon Corporation Tax Payment Voucher Oregon Gov Oregon Fax Email Print Pdffiller

17 Payment Voucher Format In Word Download Free To Edit Download Print Cocodoc

Form Or 41 V Download Fillable Pdf Or Fill Online Oregon Fiduciary Income Tax Payment Voucher Oregon Templateroller

Oregon Form 40 Esv Estimated Income Tax Payment Voucher 2021 Oregon Taxformfinder

Get And Sign Form Or Stt 1 Oregon Quarterly Statewide Transit Tax Withholding Return 150 206 003 2021 2022

Free Form 40v Payment Voucher For Income Tax Free Legal Forms Laws Com

Oregon 40 V Payment Voucher Fill Online Printable Fillable Blank Pdffiller

Oregon 40 V Payment Voucher Fill Online Printable Fillable Blank Pdffiller

Form Or Otc V 150 211 053 Download Fillable Pdf Or Fill Online Oregon Combined Payroll Tax Payment Voucher Oregon Templateroller